Hard drive boom: Seagate and WD benefit from growing demand 136 comments

Image: Western Digital

Hard disk drives (HDD), often buried in people’s minds, are experiencing real growth today. The demand in data centers for cloud and AI applications is so strong that major manufacturers Seagate and Western Digital are selling more and, above all, more expensive hard drives and making corresponding profits.

You Can Make Money With Hard Drives Again

Seagate announced promising quarterly figures with margins higher than they have been in more than a decade. Compared to the same period last year, sales increased by almost 50 percent and the gross profit margin by 13.5 percentage points, so that in the end a huge profit of 337 million US dollars was recorded.

Just a year ago, Seagate was selling about 11.9 million hard drives per quarter, earning nearly $1.3 billion. The margin was just under 20 percent. Seagate has now completed the first quarter of fiscal 2025 with hard drive sales of $2.0 billion, a sales increase of 55%. With an average storage capacity of 10.6 terabytes, the 137.5 exabytes means that Seagate has sold almost 13 million hard drives. The average selling price (ASP) was therefore around US$154. A year earlier, it was around $108.

Seagate not only sells more hard drives, but also larger drives, i.e. with more storage capacity and therefore a higher price.

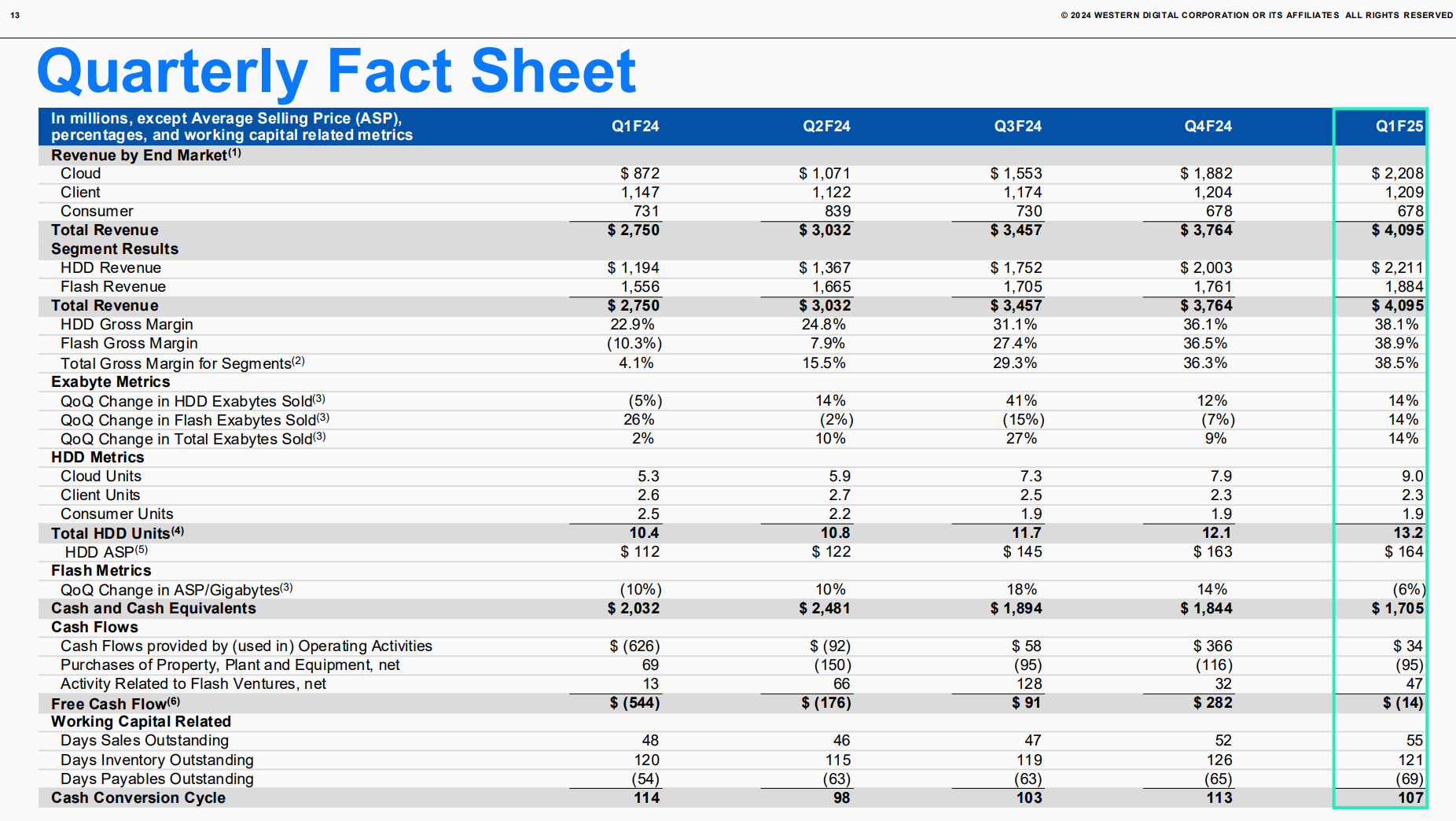

Hard drive sales in the first quarter of fiscal 2025 (year-over-year increase) Seagate Western Digital hard drive sales 2,004 (+55%) 2,211 (+85%) Hard drive sales 13 million (+9%) 13.2 million (+27%) HDD ASP $154 (+43%) $164 (+46%)

The situation is similar at its rival Western Digital, which presented its quarterly figures here Thursday evening. The 13.2 million hard drives shipped had an ASP of $164, up from $112 a year ago. Along with the massive increase in sales, Western Digital was able to increase its hard drive sales from almost US$1.2 billion to US$2.2 billion. The gross profit margin for hard drives even reached 38.1 percent.

Quarterly figures and hard drive sales at Western Digital in the first quarter of fiscal 2025 (Image: Western Digital)

Quarterly figures and hard drive sales at Western Digital in the first quarter of fiscal 2025 (Image: Western Digital)

Adding the flash business, which Western Digital plans to spin off soon, total revenue came to $4 billion, with a profit of $493 million.

The demand in data centers for hard drives (but also for enterprise SSDs) is demonstrated by the fact that Western Digital was able to increase its sales in the cloud segment by 153 percent, to $2.2 billion. . The customer and consumer domains are far behind.

And it is precisely there, in large server farms, that hard drives are truly successful, because they still offer plenty of affordable storage space with a much lower price per terabyte than SSDs. Emerging AI applications and ever-evolving cloud offerings ensure rapid growth in storage needs worldwide. The hard drive industry is experiencing a boom like it hasn’t seen in years.

Massive increase in hard drive sales predicted

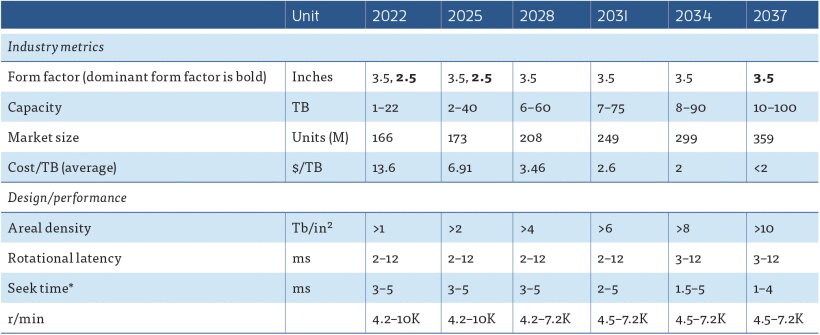

The forecasts recently published by the industry association IEEE regarding the massive increase in hard drive sales therefore no longer seem so improbable, at least in the near future. However, much depends on whether HDD manufacturers can deliver on their roadmaps with even greater capacities and even lower prices per TB and how the SSD competition will continue to approach HDDs in this regard.

IEEE Roadmap for Hard Disk Drives (HDD) (Image: IEEE) Topics: Hard Drives Seagate Storage Western Digital Economy

IEEE Roadmap for Hard Disk Drives (HDD) (Image: IEEE) Topics: Hard Drives Seagate Storage Western Digital Economy

Alice guides you through the best storage solutions, from ultra-fast SSDs to secure cloud options.